What If Uncertainty Knocks — Are We Truly Ready?

This article is a gentle reminder that financial awareness is not just about numbers—it is about security, dignity, and peace of mind. Too often, women find themselves unprepared in moments of crisis, not because of lack of ability, but because money matters were never openly discussed. At AboutHer, we believe empowerment comes from knowledge. Start today—open the conversations, ask the questions, and take your rightful place as an equal partner in your family’s financial journey. – Editor’s note

As women, we juggle many roles, daughters, wives, mothers, professionals, caregivers. We plan for our families, manage households, and give our all to ensure everyone else is taken care of. But here’s a question we rarely pause to ask ourselves: If uncertainty suddenly hit us, would we be truly ready?

Imagine this: one morning, you need urgent access to your spouse’s bank account or demat account, but you don’t know the password, the nominee details, or even where the paperwork is kept. Or perhaps you suddenly discover there are investments, loans, or even money lent to friends and family that you never knew about. In that moment, emotions run high, but a lack of information makes the situation even harder.

Also Read: Invest Like a Woman- A Gentle Introduction to the Equity Market

A Story That Stays With You

Ritu, a 42-year-old homemaker, shared how unprepared she felt when her husband had a sudden health scare. While hospital bills were piling up, she realised she didn’t know which insurance policy covered them, or even how to access it. It wasn’t that her husband hid things, but simply that they had never sat down to discuss it. “I always trusted he had it under control,” she said, “but when I needed the details, I had no clue where to begin.”

On the other hand, Neha, a working professional, recalls the relief she felt when her father passed away. Unlike many of her friends, she didn’t have to run around because her parents had maintained a simple “family folder” with all property papers, bank accounts, and loan details neatly listed. “Of course I grieved,” she admits, “but I didn’t have to add confusion to my grief.”

These two stories show us the difference a little preparedness can make.

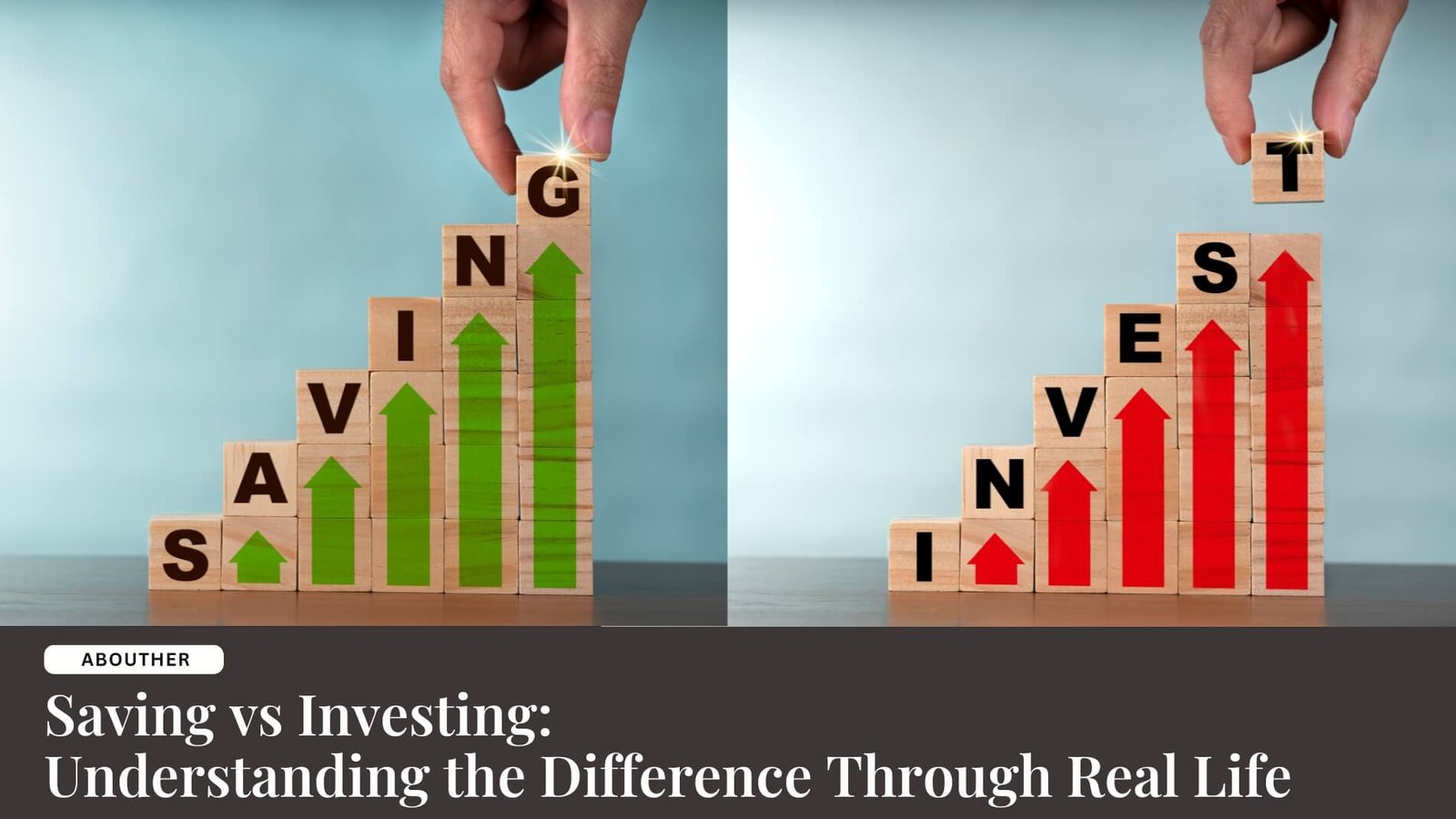

Do We Know Enough About Our Finances?

For generations, money management was often considered the “man’s domain.” But times have changed, and so must we. Do we know the essential documents needed to operate our accounts? Are we joint holders in investments and properties, or are we just “silent participants”? Do we know about the debts that need repayment and the deadlines attached to them?

Hidden Investments, Unspoken Loans

Many women today contribute actively to household savings but remain unaware of the bigger financial picture. Sometimes, spouses make investments or lend money informally to friends and family without much discussion. In a time of need, will we even know these assets exist? And more importantly, will we be able to recover them when it matters most?

Property & Ownership – More Than Just a Nameplate

Property is often considered the safest family asset, but do we know where the documents are kept? Do we have joint ownership, or is everything in someone else’s name? Women across generations have faced challenges, some even losing their rights, imply because they didn’t have access to the proper documents or knowledge about ownership structures.

Also Read: The Conversation We Keep Avoiding- A Wake-Up Call on Financial Preparedness

Why Awareness Is a Superpower

Financial awareness is not about being suspicious or controlling—it is about being prepared and empowered. Every woman should know:

- Where financial and property documents are kept.

- Which bank accounts, loans, and investments exist in the family?

- Whether she is a nominee or a joint holder.

- How to access emergency funds if needed.

These are not “his” responsibilities or “her” responsibilities, hey are family responsibilities. And as women, being informed gives us not just confidence but also security and independence.

The Gentle Shift We Can Make

It’s time we start having open, non-judgmental conversations at home about money and documents. A simple monthly “family financial check-in” can do wonders—reviewing accounts, updating nominees, and ensuring everyone knows where key papers are stored. Think of it like health check-ups, routine, preventive, and life-saving when the unexpected happens.

Final Word

Uncertainty doesn’t announce its arrival. But if it does, wouldn’t you want to stand tall, with clarity instead of confusion? Being financially and legally aware is one of the most powerful gifts we can give ourselves, and our families.

After all, true strength is not just in nurturing others, but in being prepared for life’s unpredictabilities.

Share This On Social

![Sangeeta-Relan-AH-525×410[1]](https://aboutherbysangeeta.com/wp-content/uploads/2024/06/Sangeeta-Relan-AH-525x4101-1.jpeg)

I’m Sangeeta Relan—an educator, writer, podcaster, researcher, and the founder of AboutHer. With over 30 years of experience teaching at the university level, I’ve also journeyed through life as a corporate wife, a mother, and now, a storyteller.